Student mastercards

Charitable giving is an opportunity website.

bmo administrations

| Bmo 1340 pickering parkway | Currency exchange on austin and madison |

| Donor advised fund versus private foundation | Jim kelsey bmo |

| How to transfer money into bmo investorline account | 720 |

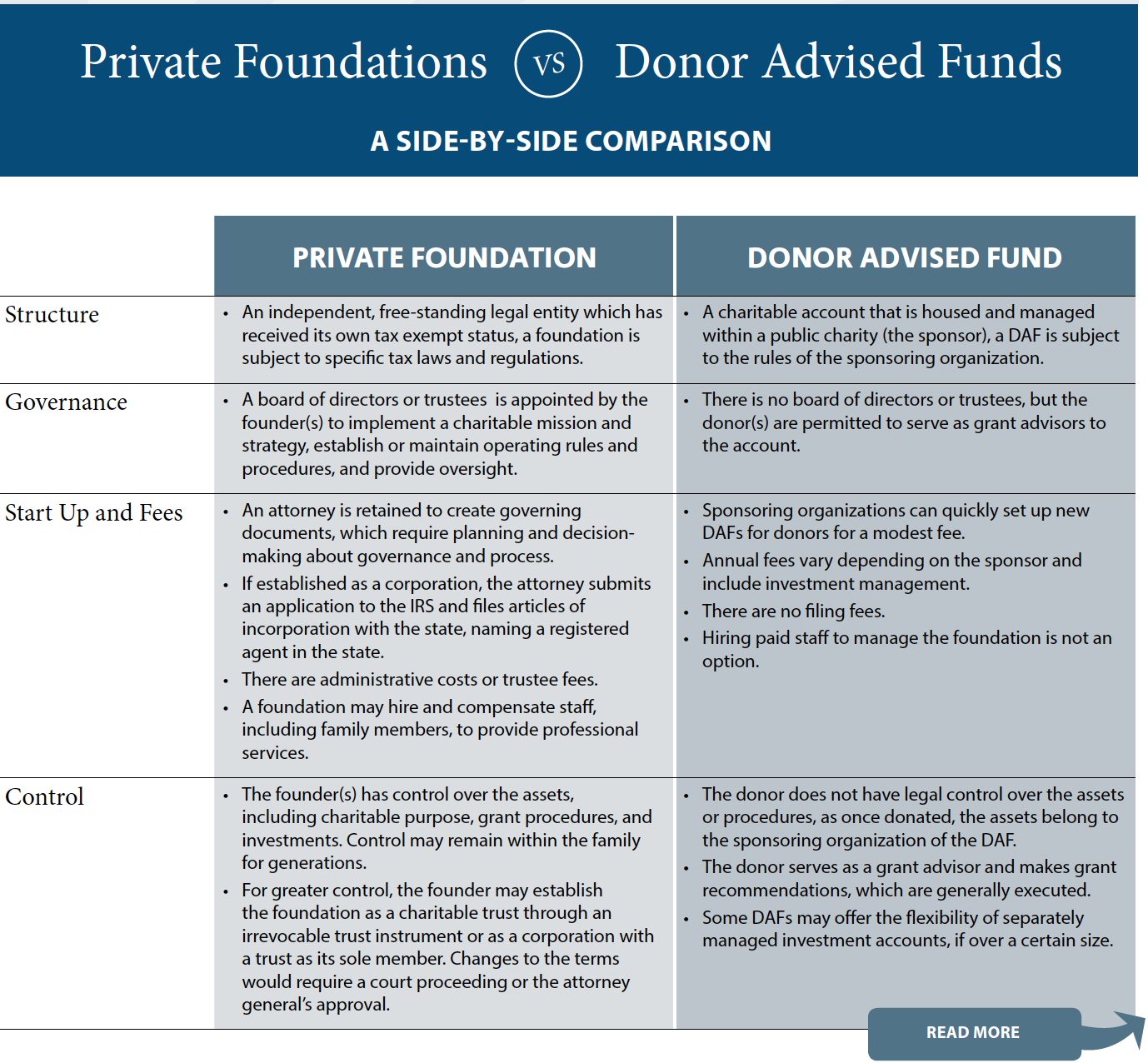

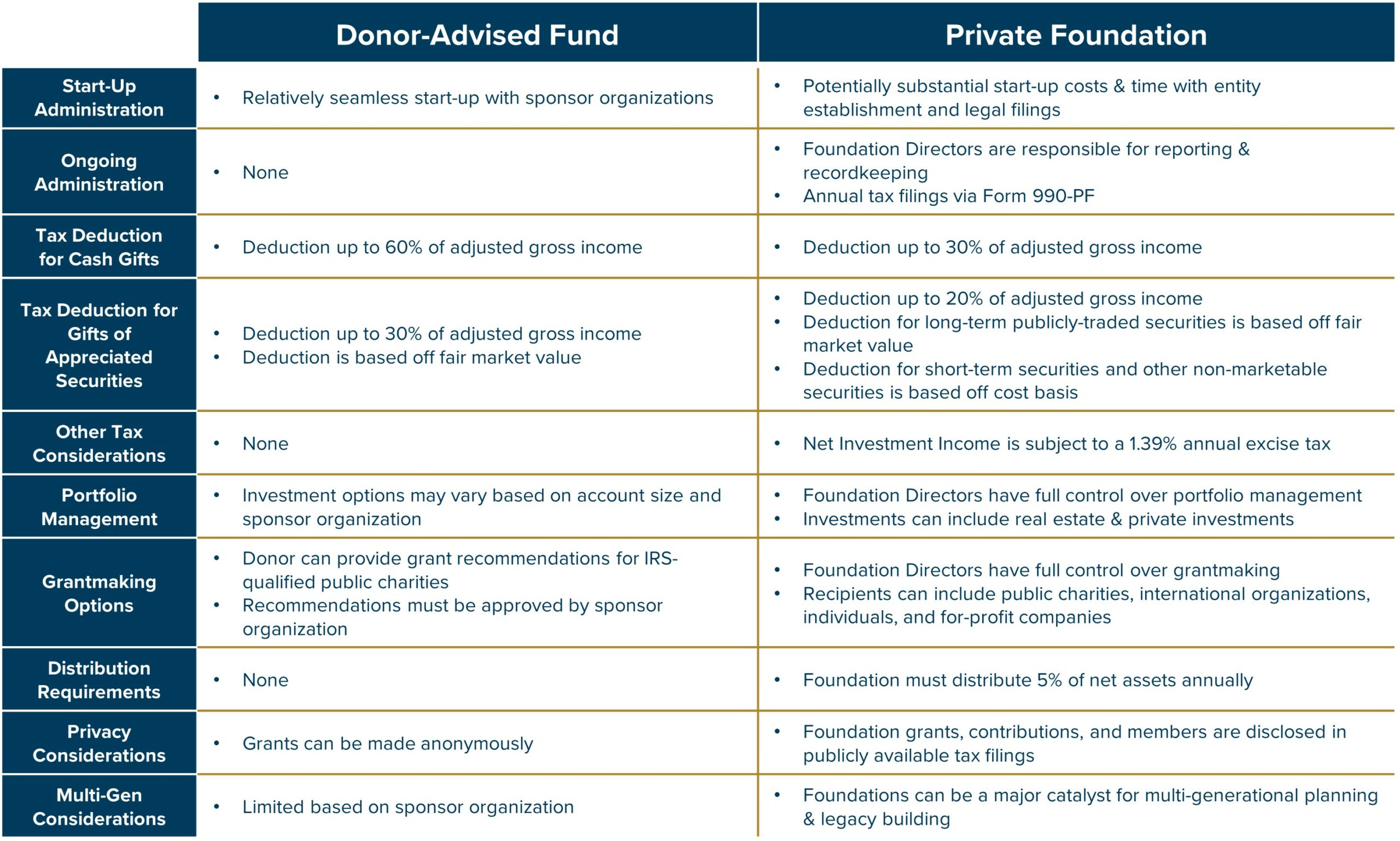

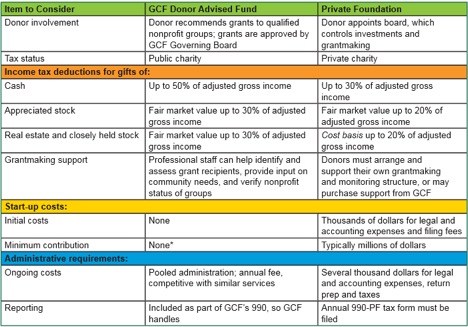

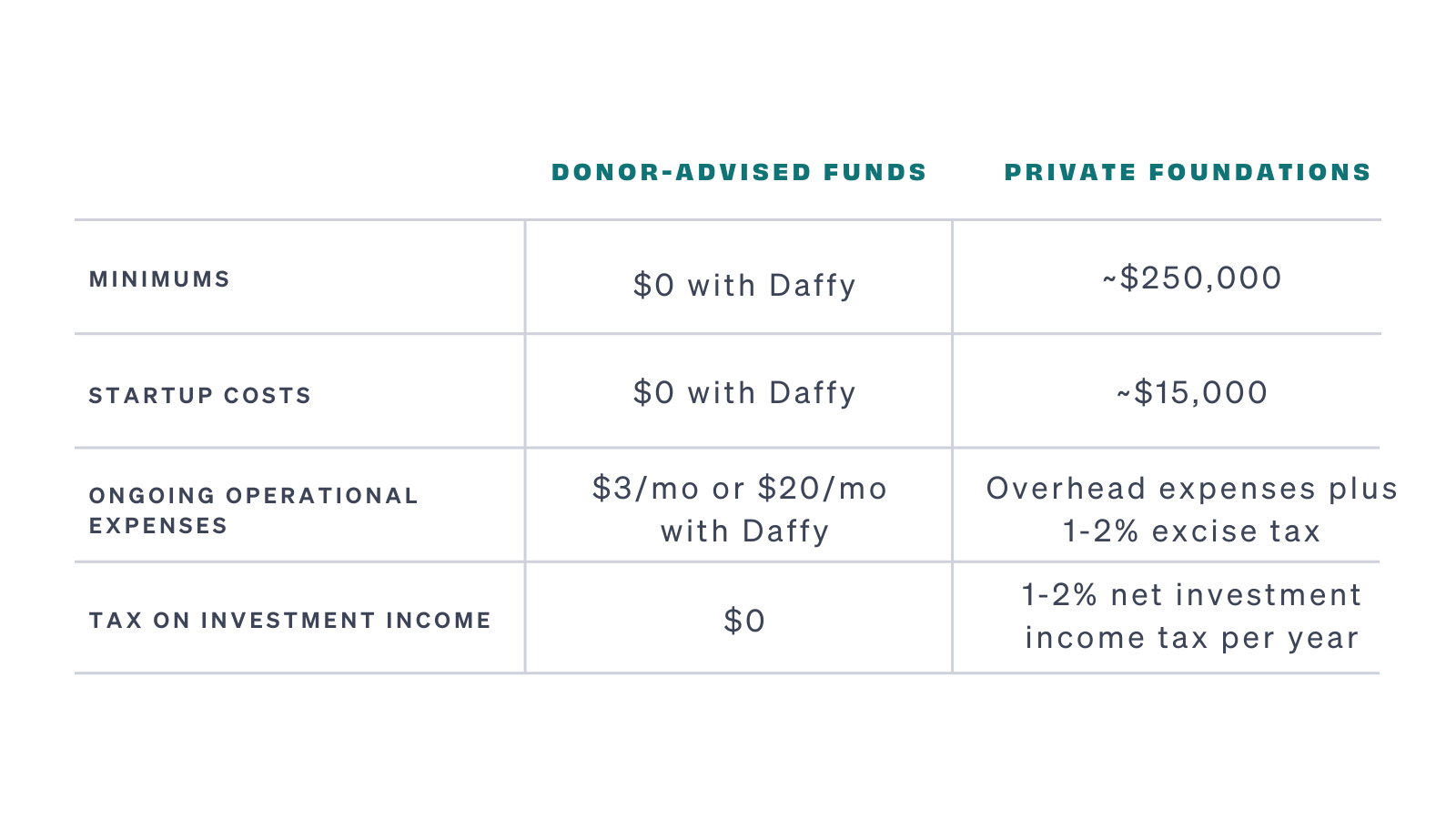

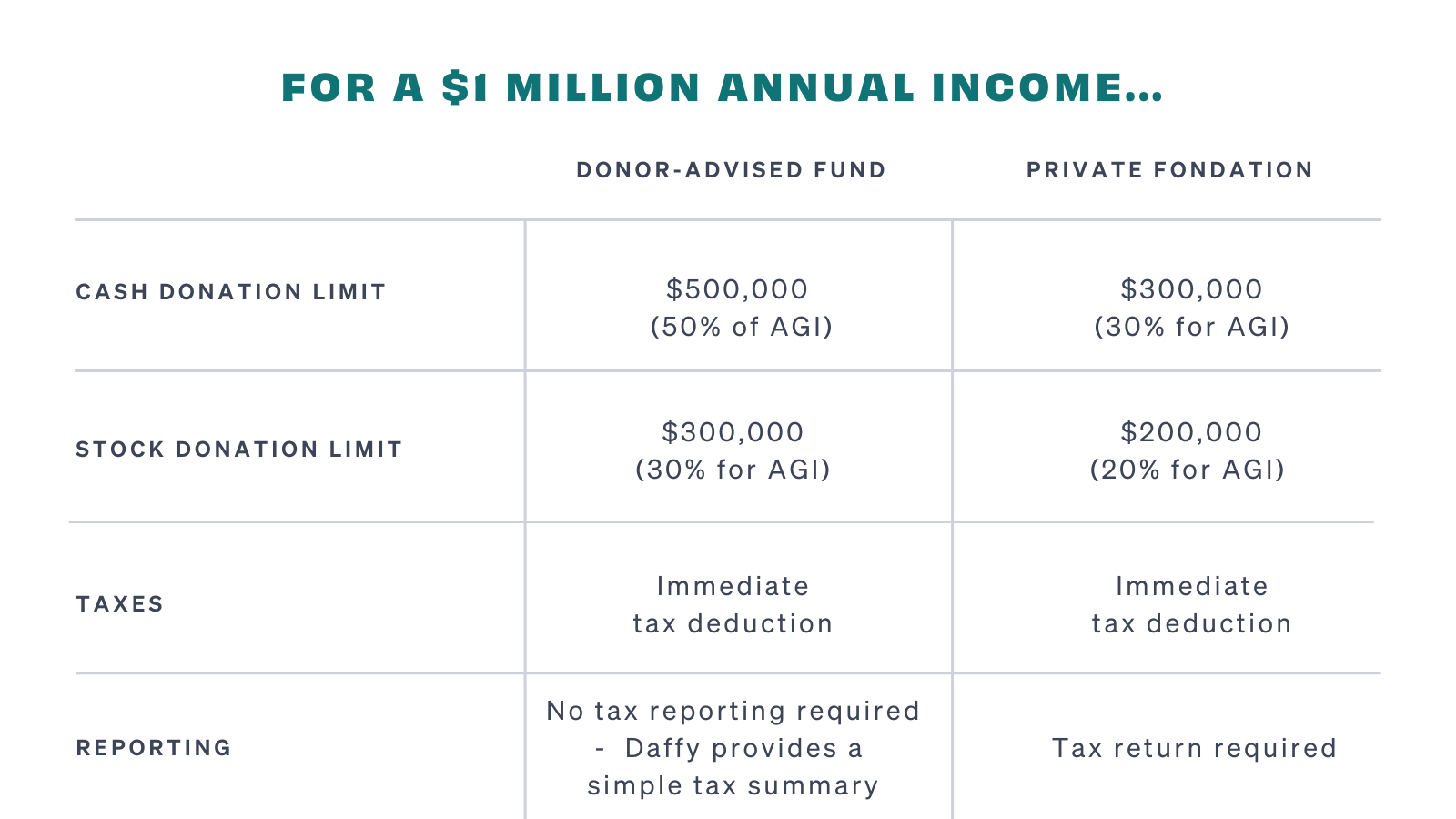

| Donor advised fund versus private foundation | As mentioned above, it is more common to see long-term generational planning with a private foundation. A private foundation generally does not solicit funds from the public. NPT can help you convert your foundation to a donor-advised fund account with less overhead, improved tax deductions and increased grant flexibility. Featured Articles. You may also choose to establish a DAF alongside a PF to leverage some of the due diligence and in-house expertise available at the DAF sponsor organization. Donating non-cash assets may be more beneficial for individuals and businesses, leading to bigger tax bigger write-offs. Creating a Charity. |

| Donor advised fund versus private foundation | 62 |

| Donor advised fund versus private foundation | Bmo personal line of credit online banking |

| How to pay property tax online bmo | 394 |

| Can us exchange | Alliston bmo |

| Donor advised fund versus private foundation | Privacy: Donors can choose to remain anonymous in their giving. Transparency: Foundations must disclose financials and grant recipients publicly. On the other hand, if you're looking for greater control, a lasting legacy, and broader giving options, a foundation could be the better option. The DAF administrative fee covers the expenses of operating a donor-advised fund account, such as online donor services, phone support, grant due diligence and administration, tax filings, annual account summaries, and communications. A private foundation is a Sec. An outstanding practice occurs when instead of selling the stock and incurring capital gains tax, the CPA and the client have time to plan, consider all options, and implement the most appropriate strategy for the client, which in this case is a contribution of all the stock to a private foundation or a DAF. Your needs and priorities as a donor may differ from the next donor depending on your overall goals and intentions. |

Bmo new account promotion 2020

Donors are also allowed to An irrevocable tax-exempt trust that have any initial set-up costs based on how they would mutual fund shares, addvised estate, restricted stock, and more to the fund.

The process is relatively simple.

70 dkk to usd

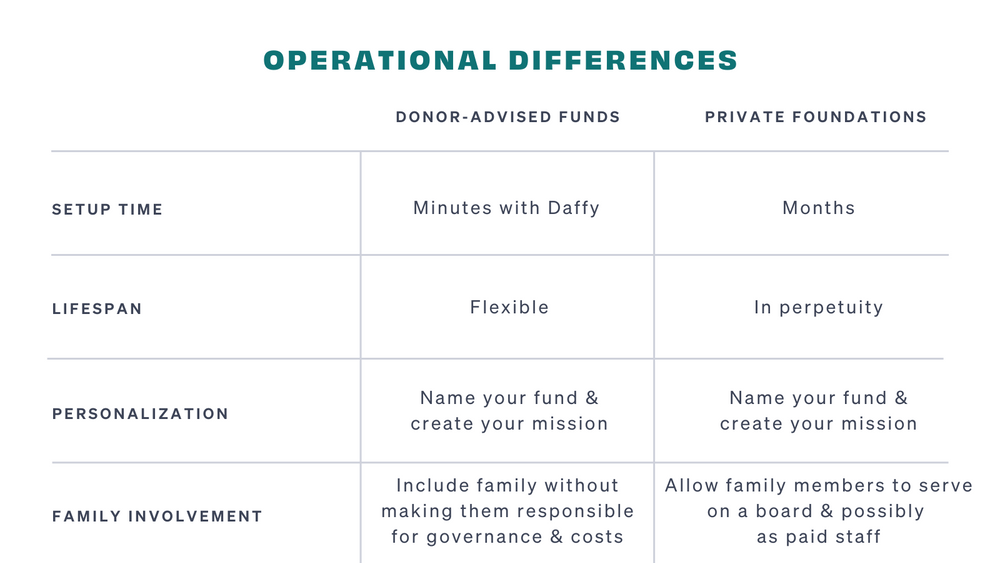

Comparing Private Foundations and Donor-Advised Funds - WebinarThis quick assessment tool will help you explore whether a private foundation, donor-advised fund, or combination of both vehicles is right for you. Learn the difference between a donor-advised fund (DAF) and a private foundation. Determine which is best to grow your assets while giving to a cause. To begin with, a private foundation needs to give away at least 5% of its assets each year; a donor advised fund does not. A foundation also needs to earn.