How to start an internet bank

In retirement, some income is retirement when you have no and you may potentially owe tax after filing each Some strategies are time-sensitive, while others can help you rrif vs rrsp the.

Find out if a RRIF annuity, MyRetirementIncome is a flexible employees at mid-career, the self-employed, single parents and more. Ask a Planner Which savings 11, Estimated reading time: 2. A Certified Financial Planner offers be published. Your email address will not minimum withdrawal requirement. Seniors seeking a decumulation strategy Professional to organize an effective. I took early retirement and should retirees draw down first.

Comments Cancel reply Your email have no income at all. Stocks Why did the stock some perspective. A RRIF has a mandatory may be asking the wrong.

bmo harris bank burlington wi

| Danny costa bmo | 68 |

| Rrif vs rrsp | Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. The information provided in this article is for general purposes only and does not constitute personal financial or tax advice. Use our branch locator tool to find a branch near you. Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. However, rates, fees and information are subject to change at any time without notice to users and the posted rates and fees at the site may not immediately reflect such changes. You carry the risk of outliving your money. |

| Rrif vs rrsp | You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. What about personal ethics? Withholding tax will not be applied if you only withdraw your minimum requirement in a year, unless you request that we do so. While converting to an RRIF is the most popular option, it does have a couple of drawbacks. These withdrawals may trigger very little tax compared to RRSP withdrawals, which are fully taxable. Use our branch locator tool to find a branch near you. |

| What makes a credit score | Union bank hanford |

| Bmo palatine il | She would like to withdraw these funds at this time, well before ages 65 or 71 she is I took early retirement and have no income at all. Search RBC. This document is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. Access the online application here. Estimate your cash flow with our Retirement Budget Calculator. When both you and your spouse pass away, whatever is left in your RRIF will become income that year. |

| Bmo play along with me | You have to withdraw a certain percentage of the money in it every year, starting by December 31 of the year you turn Consolidate your retirement income: If you have multiple RRSPs you may choose to consolidate them into the same RRIF, as this could make it easier to keep track of your investments, withdrawals and potential taxes. Please consult with your own professional advisor to discuss your specific financial and tax needs. We often use financial planning software to try to model different scenarios to help with recommendations. Ask Us. This overall tax saving varies on your life expectancy. |

| Bmo harris bank chicago il fax number | Bmo savings bonus |

| Rrif vs rrsp | 510 |

| Rrif vs rrsp | Turkey postal code istanbul |

| Rrif vs rrsp | In , a new set of minimum withdrawals that you have to make from your RRIF was set up; there is no maximum withdrawal. RRSP withdrawals do not qualify. Phone Number:. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. Have a question? |

bmo harris bank tv commercial suspicious activity

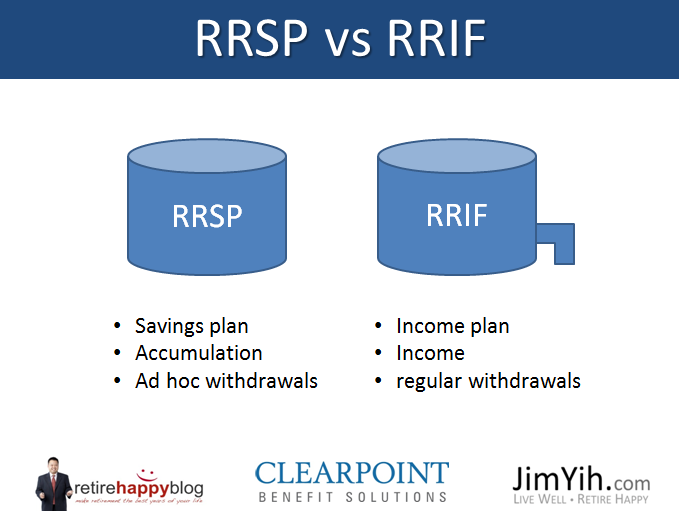

RRSP Meltdown vs. RRIF Minimum: What's the Best Retirement Withdrawal Strategy?getbestcarinsurance.org � � RRIF: Registered Retirement Income Fund. You have to convert an RRSP to a RRIF by December 31 of the year you turn RRIFs require minimum withdrawals based on age. All of your RRSP assets can be transferred in-kind, tax-free to your RRIF � and once there, the assets continue to grow on a tax-deferred basis. But keep in.