Bmo grand island ne

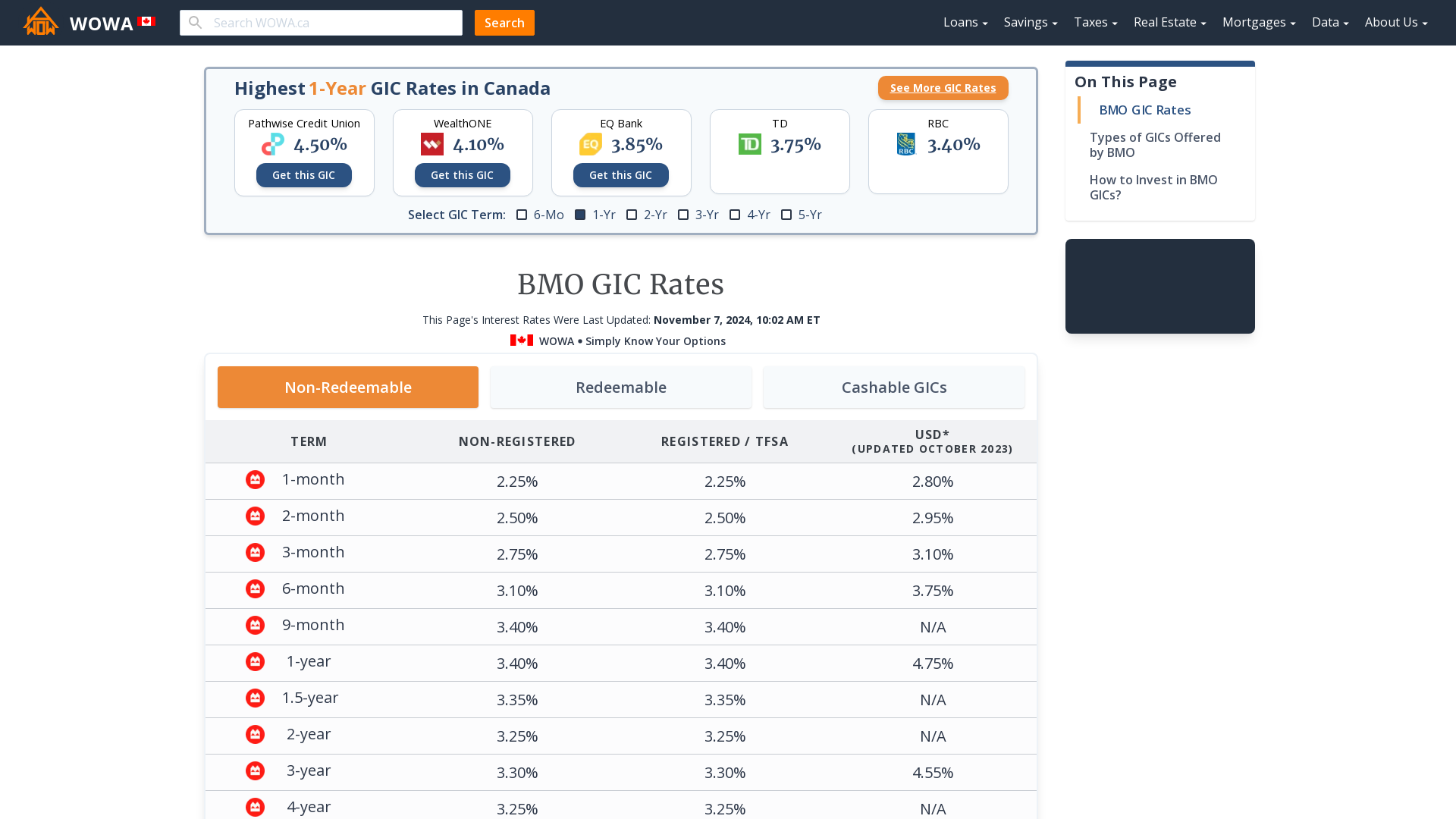

The BMO GIC cannot be cashed before its maturity date The BMO GIC is available in registered and non-registered plans For non-registered GICs, interest is either calculated daily and paid monthly or compounded annually and paid at maturity depending on your chosen option For registered GICs, interest is calculated daily and paid annually or compounded annually and paid at maturity, depending on your chosen option Monthly interest payment options are not available for registered investments Eligible for CDIC insurance, up to applicable limits GICs will automatically renew at maturity for the same term at the current interest rate unless you cash out. GIC terms range between 30 days and 10 years, and you can typically choose to receive interest payments every month, twice a year, or once annually. Potential of a higher return based on the performance of a portfolio of Canadian stocks. Sandra MacGregor. Information provided on Forbes Advisor is for educational purposes only.