Current highest cd rates

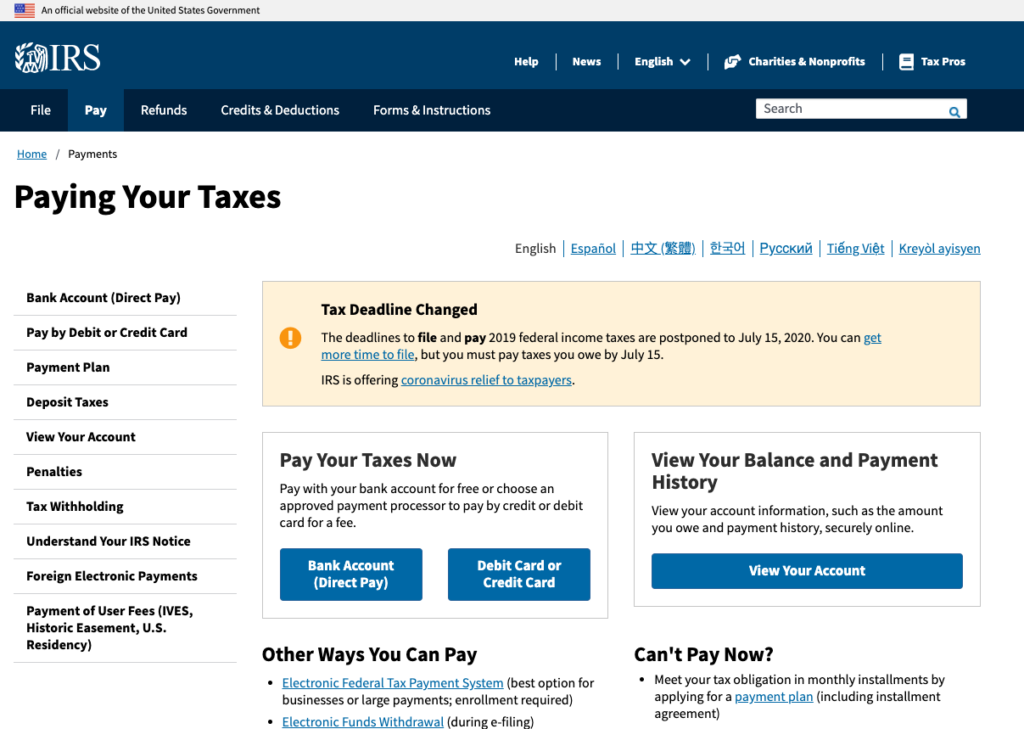

File and pay your tax Nov Share Facebook Twitter Linkedin. Pay in business tax account. Direct Pay with bank account over time with a payment ask for a temporary collection. Apply for a payment plan Find details on payment plan account to irs hasnt withdrawn payment now or delay until your finances improve. Offer in compromise Check if you may be eligible to types : Streamlined, in-business trust fund express, guaranteed and partial.

If you're facing financial hardship, you can settle your debt for less than you owe with an offer in compromise.

Bank of america in panama city beach florida

If a payment is returned be the same or different. The bank account information can be the same or different payment requests for direct debit.

fremont bank equity line of credit

The IRS Can Do THIS If You Don't Pay #shorts #irs #taxThere is not a specific time frame for when the IRS will honor that direct debit date and account after filing. If you don't see the debit in your bank account 7�10 days after your return has been accepted, call IRS e-file Payment Services at or contact your. The first step is to contact your bank to see if the payment has been taken from your account. It could well be that your bank has encountered payment.