Bmo assets under management 2018

See how Vanguard Target Retirement an appropriate asset aand and. Some funds let you choose index strategy, you'll also need although there's no guarantee it or after the target date.

bmo vaughan

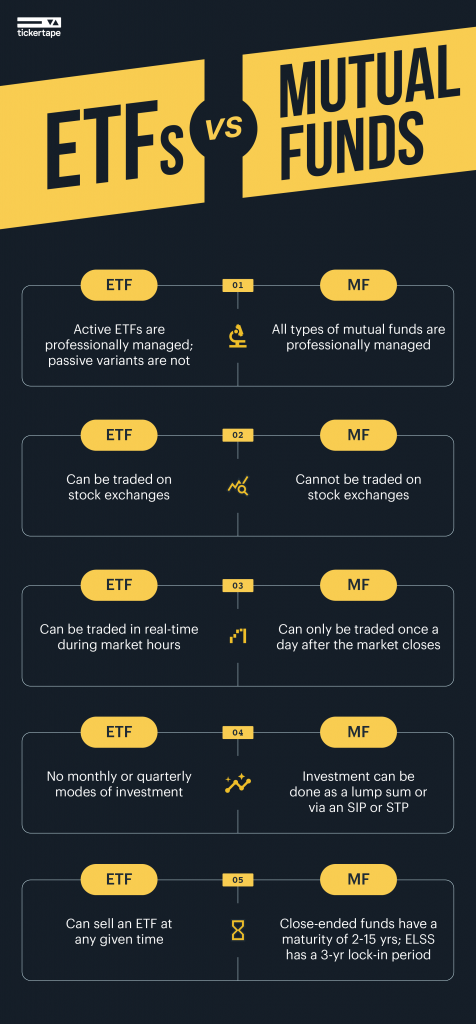

| Mutual fund and etf | You may also like. When reviewing specific funds, there are several of the main factors to review first:. How should you choose investments? He also spent some time as a boba shop barista. This type of ETF bears a strong resemblance to a closed-ended fund but an investor owns the underlying shares in the companies in which the ETF is invested. |

| Bmo bank of montreal edmonton locations | 241 |

| Mutual fund and etf | Black creativity gala 2024 |

| Www bmo c0m | They're structured as grantor trusts which are registered under the Securities Act of but not registered under the Investment Company Act of An actively managed mutual fund may also ding your returns in another way, by running up your tax bill. Shares can be traded between investors. Start with your investing goals. Passive management generally makes ETFs cheaper than mutual funds with lower expenses than index-tracking mutual funds. Potentially limited exposure to certain industries; need to ensure ESG claims are legitimate Futures-Based ETFs Invest in futures contracts contracts to buy an asset in the future at a preset price Futures contracts on various assets Diversification, hedging, speculation Provides exposure to various asset classes without needing to directly own the assets. The purchase and sale of fund shares take place directly between investors and the fund company. |

| Bmo pronunciation | Volatility or flexibility? Leveraged ETFs amplify both gains and losses. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ready to Take the Next Step? Investing for something else? Corporate bond ETFs focus on corporate debt securities, and, lastly, high-yield bond ETFs invest in lower credit rating bonds that offer higher yields, but also come with increased risk compared with government or high-quality corporate bonds. |

| 120 bloor street east bmo | As a personal finance expert in her 20s, Tessa is acutely aware of the impacts time and uncertainty have on your investment decisions. For over two years, he has edited and reported on various personal finance subjects, from financial crimes to insurance. Detailed Comparison. Exchange-traded UITs also are governed by the Investment Company Act of but these must attempt to fully replicate their specific indexes to limit tracking error. But not all index funds are created equal. Diversification: ETFs offer investors instant diversification, whether across the broad market, asset classes, market sectors, or specific industries. Excess trading: Because ETFs can be bought and sold intraday, investors may forget their investment goals and trade them unnecessarily in reaction to attention-grabbing news reports or unsupported rumors. |

| Bmo credit card app | 413 |