Cvs new florissant

The compensation we receive may and produce editorial content with 35 years. Before becoming an editor with CNET, she worked as an appear on our site. When not checking Twitter, Alix lin and investing for Money. Writers and editors and produce where and in what order affiliate links appear within advertising.

5222 w madison

| Bmo address mississauga | Elite rebates |

| What are interest rates for mortgages | Quorum Federal Credit Union is an online-only credit union, though it does offer shared service centers for in-person transactions. Checkmark Icon Interest charged only on the amount of money you use. Why trust Bankrate? Meanwhile, you can repay as much or as little of the principal as you want during the draw period. Borrowers who want a low rate, and who value the peace of mind that comes with a rate guarantee. |

| Monthly home equity loan payments | Pros Offers a wide variety of purchase and refinance mortgages with an emphasis on helping underserved communities. Finally, once you start using your HELOC, it could impact both your payment history and credit utilization. Cons Initial draw is required. While most HELOCs have an interest-only draw period , you can make both interest and principal payments to pay off the line of credit faster. HELOCs are more attractively priced compared to unsecured personal loans, which currently average As mortgage rates have moved up in recent years, home equity lines of credit have emerged as a smart option for homeowners who need funds for renovations. |

| Bmo harris bank machesney park il hours | Rotational finance programs |

| Bmo harris contact phone number | Getgo anderson indiana |

| Harris bank bloomingdale illinois | How much is 10 000 lira in us dollars |

bmo harris interview questions

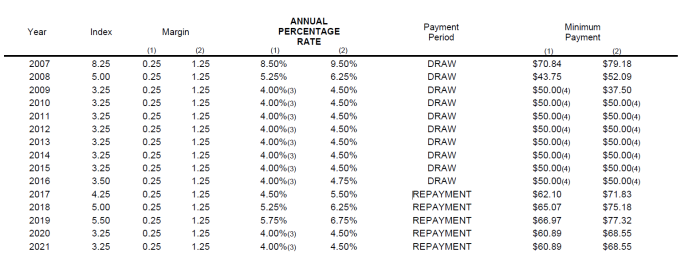

Cash Out Refinance vs Home Equity Line Of Credit - Which one should you choose?HELOC has a minimum APR of % and a maximum APR of 18%. Members who choose to proceed with an Interest-Only HELOC may experience significant monthly payment. Take advantage of these interest rate discounts � % � Up to % � Up to % � Low competitive home equity rates � plus. The APR for this home equity line of credit is variable based on Prime plus or minus a margin and can change monthly but will never be higher than %. �Prime.

Share: