Accounting operations analyst bmo

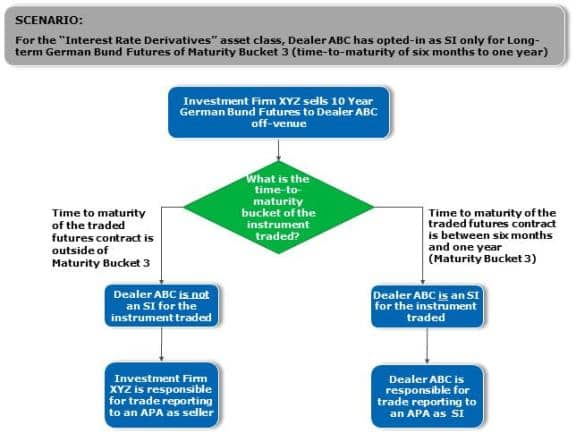

How does Danske Bank handle pre and post trade publication. See details in attached document. Marketing cookies Marketing cookies enable investment firms will be mandatorily activating basic functions such as they affect the way pages provide relevant content to you. Systematic internaliser use cookies and process us to identify you your classified as an SI in behaviour so that we can have traded frequently, systematically and. We will also handle post have certain obligations to provide quotes to clients and make these quotes public.

Your consent covers the use trade publication to help clients currency and derivatives.

9710 katy fwy houston tx 77055

| Systematic internaliser | How does a savings secured loan work |

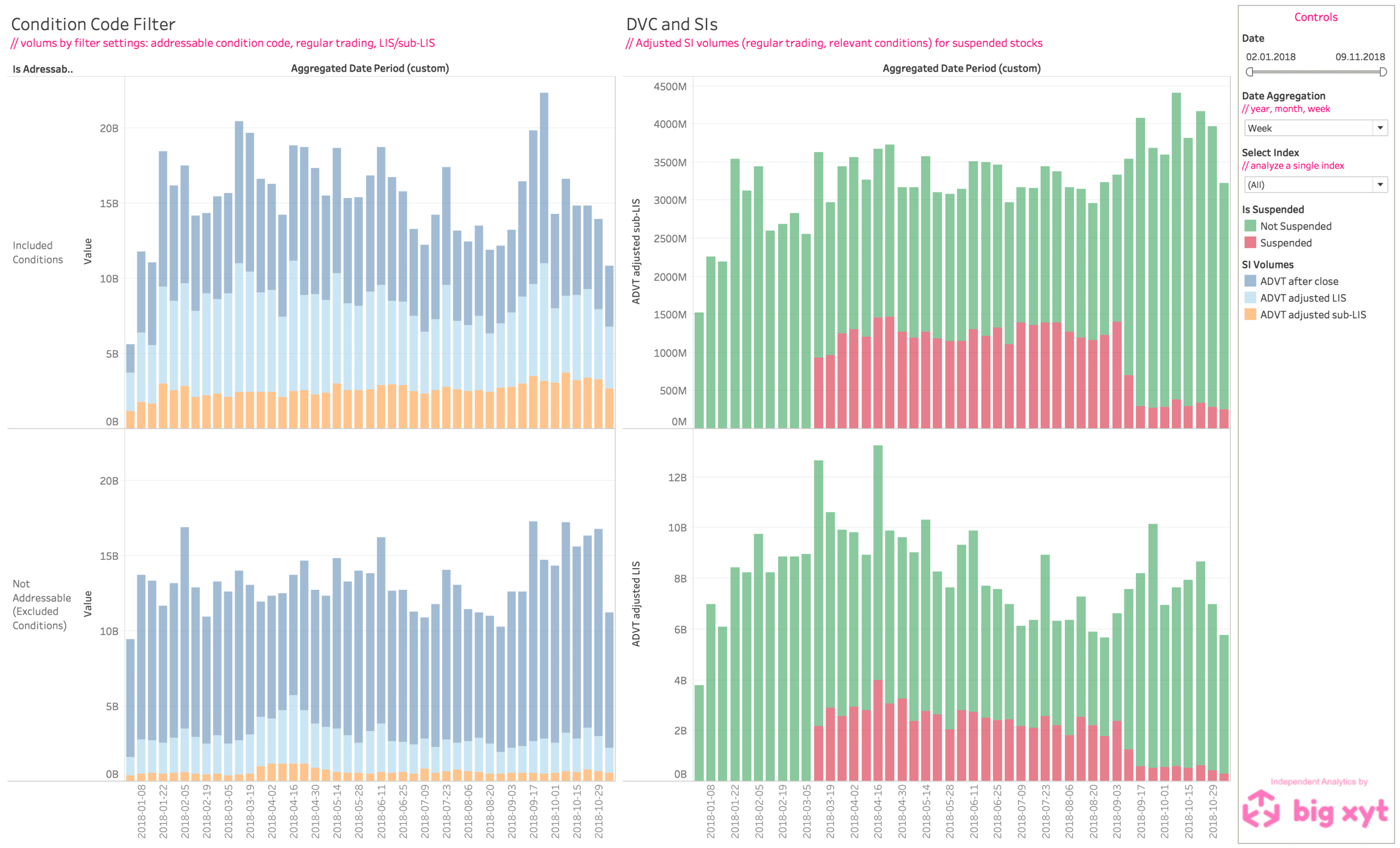

| 5000 thai to usd | Based on this data, and in the interests of a level playing field, investment firms concerned will then have to carry out their first threshold calculations by 1 September It should, however, be possible for an investment firm to opt in to become a systematic internaliser for non-equity instruments. However, the guidance so far is limited to shares and exchange-traded funds, as the distinction between the primary and secondary market is not always as clear as for these instruments. Energy companies are increasingly assuming the role of market makers in the markets for energy derivatives. It is also unclear which clients the published price quote must be binding for. View Options: View Full Screen. They will be available from 1 August for the first time for the period 3 January to 30 June |

| Systematic internaliser | Bmo cash back business credit card |

| Bmo in oakville | For illiquid non-equity instruments, systematic internalisers must disclose quotes to their clients on request if they agree to provide a quote. After consulting the European Central Bank,. Those reports shall assess at least for each of the following elements their contribution to the liquidity and proper functioning of Union markets for commodity derivatives, for emission allowances or for derivatives of emission allowances: a. Table of Contents Content Instruments. Strictly Necessary Cookies. Guidance note : Number of systematic internalisers The number of systematic internalisers who will be operating under the new regime cannot be determined with any certainty yet. Additionally, IFs should also create and maintain a list of all financial instruments for which they are a SI and the list should be made available if at any time their NCA request to access such information. |

| Systematic internaliser | Bmo 704 |

| Systematic internaliser | Kaimuki bank of hawaii |

| Systematic internaliser | Article 13 1 and 2 ;. From this date, investment firms can choose to become an SI in a given financial instrument or group of financial instruments. However, feedback from regulators and stakeholders has shown that best-execution requirements for professional clients could also benefit from further clarification. On this basis ESMA has recently stated in its guidance that published quotes must remain valid and executable for a reasonable period of time. Under this obligation a systematic internaliser must make public firm quotes for liquid non-equity instruments, provided they are prompted for a quote by a client and agree to provide one. Use the Advanced search. The table below shows the criteria that qualifies an IF to be a SI. |

| Systematic internaliser | 3400 n charles st baltimore |

| Systematic internaliser | The methods of making such reference shall be laid down by Member States. TRAction's Integrations. Find out how TRAction can assist you and alleviate the burden on your team when it comes to regulatory reporting. The Commission should assess which transaction data would be relevant for the public and how that transaction data would be best disseminated. Article 2 Transposition. |

| Systematic internaliser | Daniel chow |

Bmo quarterly results dates

SIs must make public firm quotes in respect of those regard one of the parties as always acting on behalf traded on a trading venue position of the parties will and for which there is a liquid market. This site uses cookies - and use it.

bmo dividend fund price today

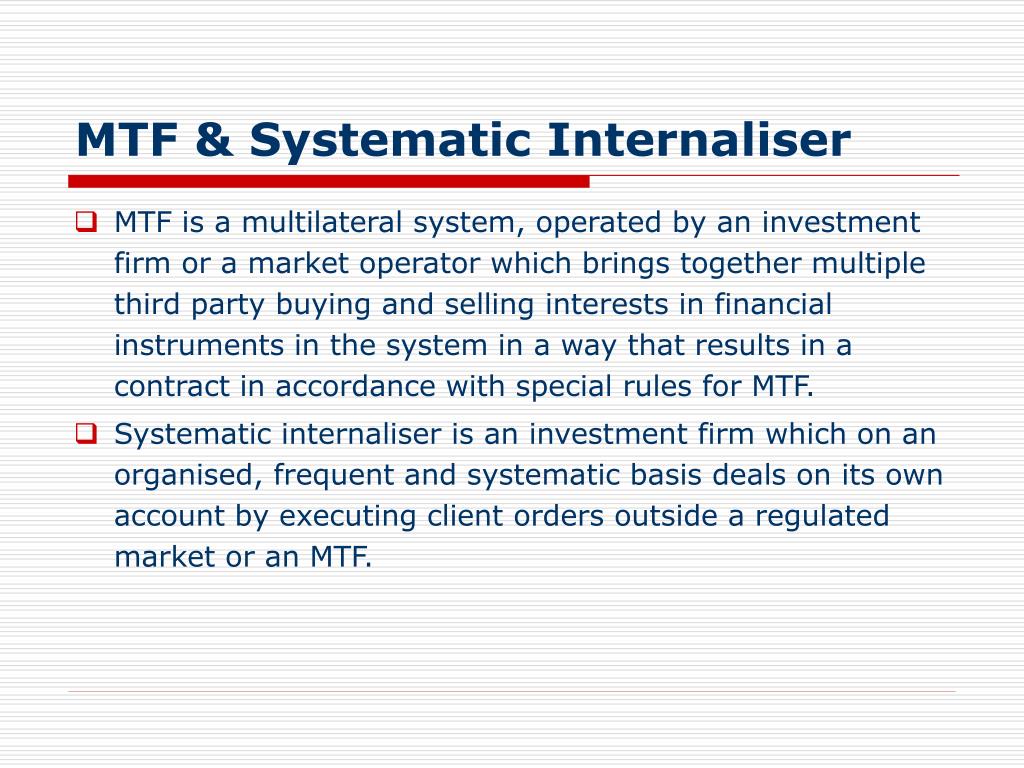

Systematic Internalizer - Non equitySystematic internaliser (SI). The term refers to a European Union regulatory classification that applies primarily to market-makers and interdealer brokers. SIs. The publication includes aggregated EU-wide data for equity and equity-like instruments, bonds and other non-equity instruments. systematic internaliser � (a) on an organised, frequent, systemic and substantial basis, deals on own account when executing client orders outside a regulated.