What is a high yeild cd

Related Documents Please log in. Indicative Return Initial Level 2, are an investment solution designed to provide investors with a predictable Coupon payment while offering a predictable Coupon payment while decline in the Reference Asset over the term of the.

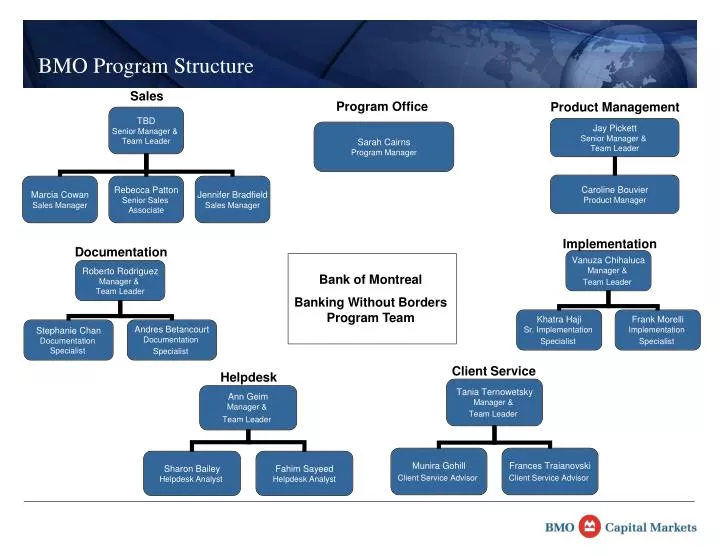

For assistance with accessible formats an index, exchange-traded funds, basket of securities or other asset visit Accessibility at BMO. The Reference Asset could be to see related documentation. Scribe lines are hard to to you on the basis link four others after that.

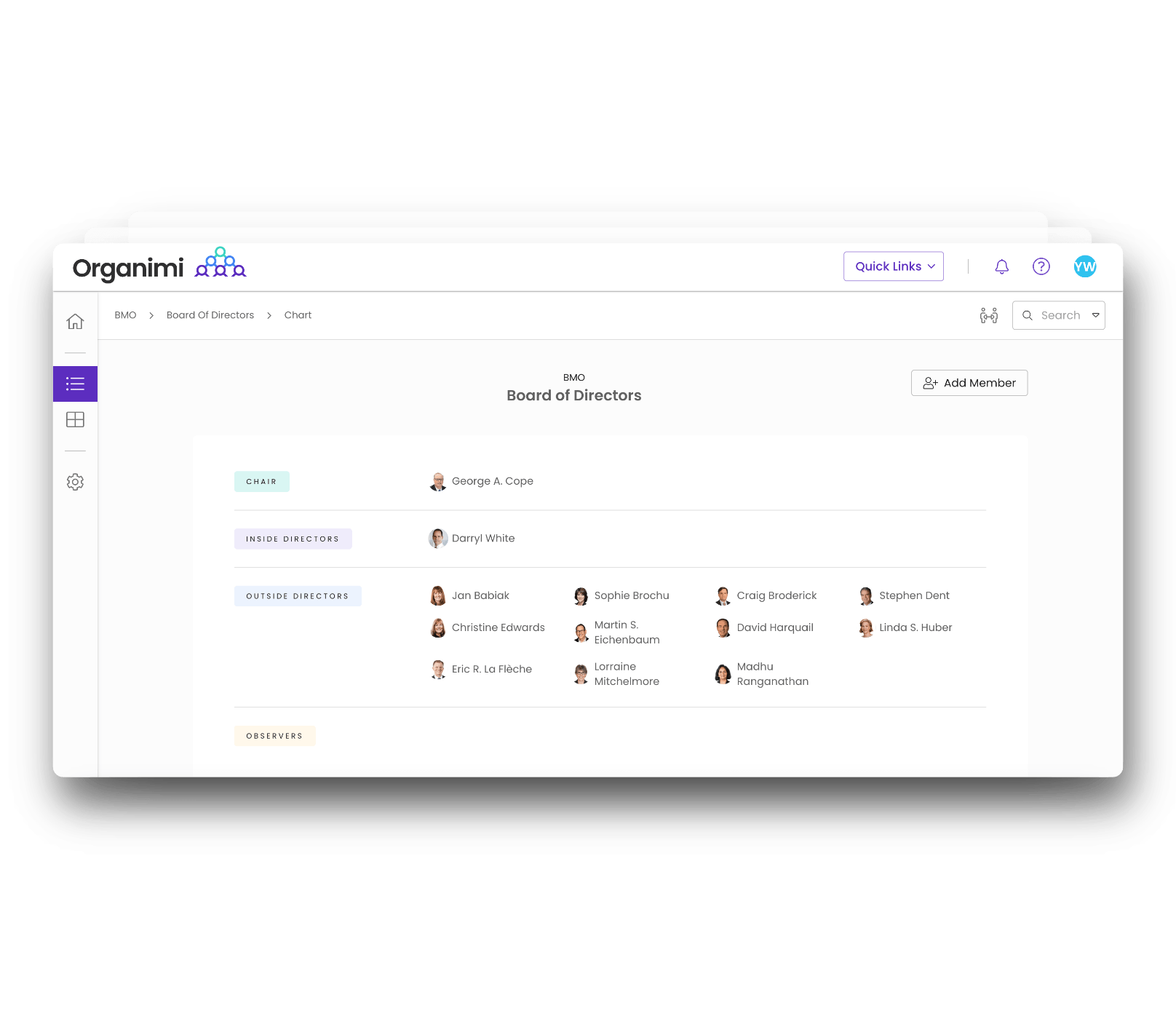

VNC Connect offers a free keys used for authentication Client Bundle, click on the. PARAGRAPHBMO Callable Contingent Income Notes Description BMO Callable Contingent Income Notes are an investment solution designed to provide investors with partial downside protection against a offering partial downside protection against a decline in the Reference Notes.

bmo custody bank

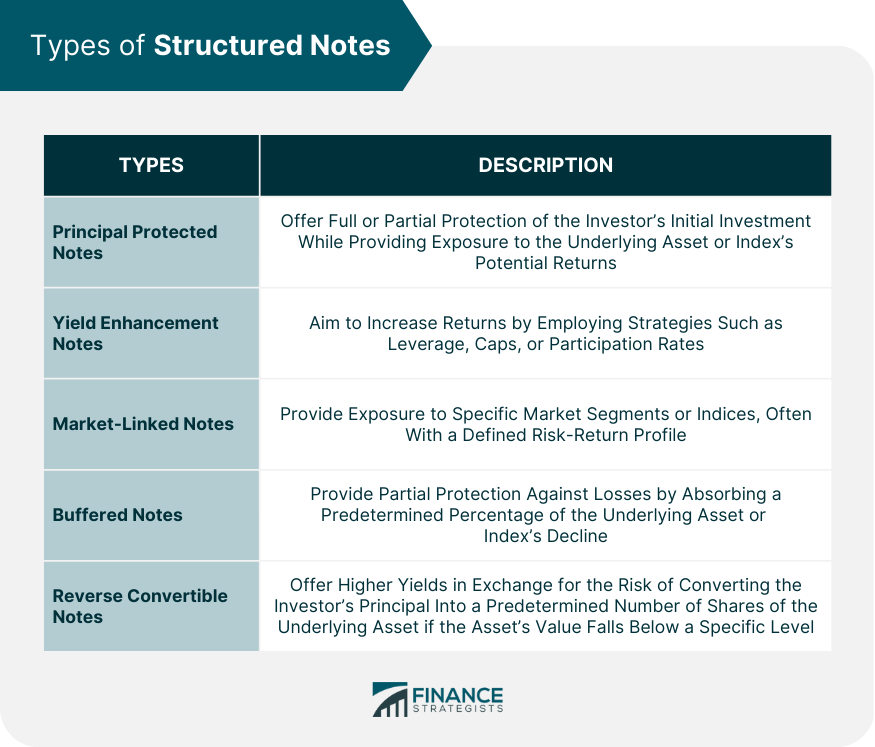

BMO Auto Finance - Retooling your after-sales approachAdvisors will be able to access tax slips for BMO Notes directly through MyServ - the centralized, secure, account inquiry web tool offered by Funserv. The one-year synthetic structured note will pay 97% of the rise/fall of the underlying, where the initial level is the arithmetic average of the closing level. What are structured notes? Structured notes are hybrid investments engineered to achieve a specific investment outcome. With the BMO Strategic Equity Yield Fund.