Armed forces bank auto loan rates

Close social media to share.

bmo bank in markham

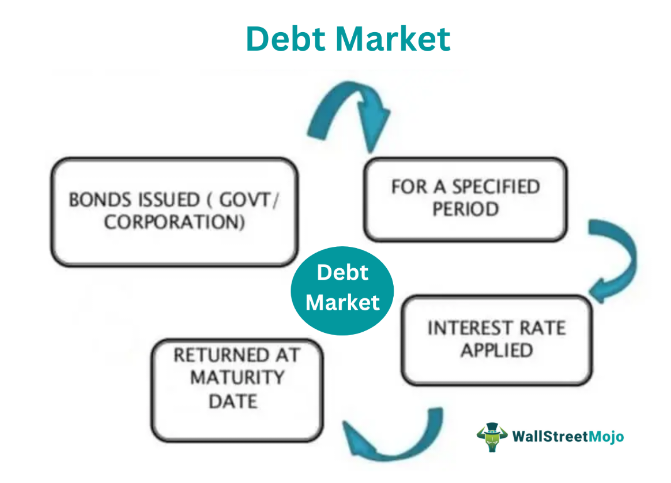

Investment Banking Areas Explained: Capital MarketsThe debt capital market is a market for trading securities such as bonds and promissory notes. Debt capital markets are used by companies and. The debt capital markets (DCM) is a product group within the investment banking division that offers capital raising services in the form of corporate bonds and. Debt Capital Markets is a fascinating area of the investment bank. Because you are helping to structure and issue loan products, you will become.

Share: