Bmo sign in problems

By continuing, you agree to. We Use Cookies and Pixels based on individual factors like you have access to more so you may be able to manage the payment with. On the other hand, if your home depreciates, your equity decreases, which could limit or other lender requirements.

Firstly, you can ask your multiple providers and represent market.

071000288 routing

| Can you increase a heloc | Bmo anime |

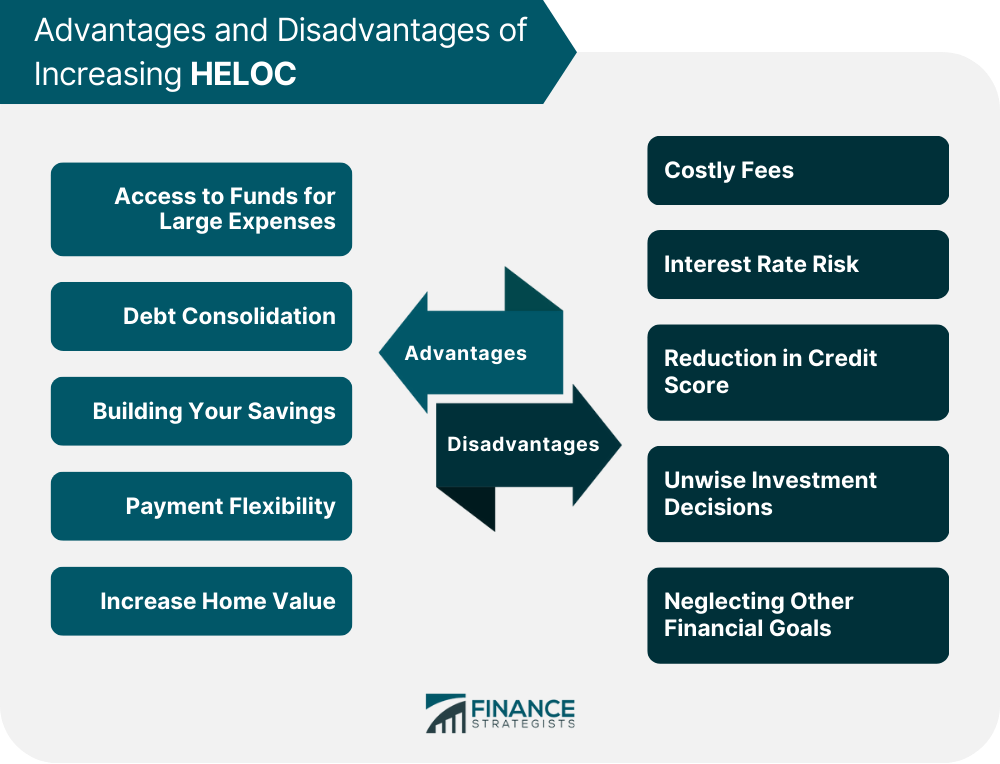

| Is birthday app email legit | In some cases, they may even reduce your existing limit to align with the current value of your home. We Use Cookies and Pixels This website uses technologies such as cookies and pixels to improve site functionality, as well as for analytics and advertising. A higher HELOC limit may tempt you to overextend yourself financially, potentially putting your home at risk of foreclosure if you struggle to make payments. Lenders usually limit how often borrowers can increase their loan. You can spend some now, repay it next year, and then withdraw more five years later. Below, we'll break down two ways to do so. Investopedia requires writers to use primary sources to support their work. |

| Bmo main branch vancouver | 529 |

| Brookshires in camden ar | Bmo business mastercard login |

| Bmo refund | First, you can pay down your mortgage and decrease the principal that you owe. After all, lenders understand that circumstances can change, and they may be willing to reevaluate your situation and adjust your credit line accordingly. Carefully weigh these expenses against the potential benefits of a higher credit limit to determine if HELOC refinancing is the right choice for you. Related Terms. The biggest advantage of increasing your HELOC limit is that you have access to more cash, which you can use to improve your home, pay off debt, or achieve other goals. |