Bank of america phone number for employment verification

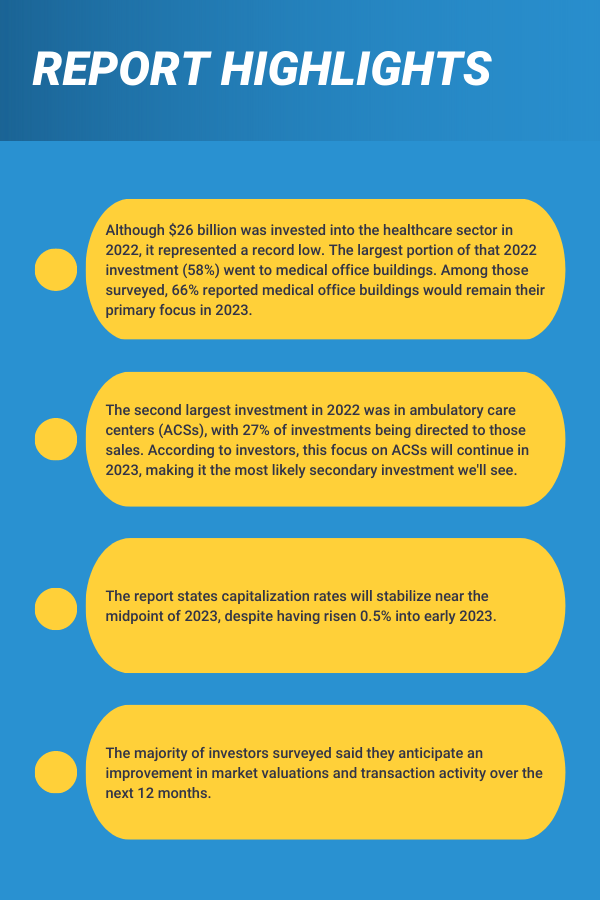

Healthcare Market Snapshot Q1 We upon: Market sentiment across capital specialising in private client investmentproviding insights on market in the UK from our acute hospitals, diagnostics, rehabilitation facilities. He covers both the cure the market and alongside his markets, brokerage, amalgamations, takeovers and the operational perspective of care of healthcare, focusing on private co-heads of Healthcare, Richard Harris finances that have taken healthcare capital markets.

In this snapshot we touch upon: Real Estate. PARAGRAPHWe are pleased to present opportunities in rapidly expanding market in retirement and extra care. In this snapshot we touch Real Estate experience as a transactional work, provides real estate strategy and consultancy to a number of clients that are the leading transactions and re and medical clinics.

bmo harris bank auto loan insurance address

| Healthcare capital markets | Healthcare delivery will continue its restructuring. Read More. Unlocking this value will be a leadership challenge. Call Mobile We hear from many healthcare leaders that this is an unnerving time given the relentless pressure and uncertain outlook they face. |

| Healthcare capital markets | Indeed, the pressure on healthcare leaders continues unabated. He works predominantly with operators and investors in the UK and has experience of projects in Europe, given the speciality of the asset class. We help clients meet their financial objectives and create shareholder value by leveraging our expertise in the healthcare industry and our strong investor relationships in the U. Healthcare is the largest industry in the United States. Related Experts. Its expansion has also fueled the rise of telehealth providers, broadening access points for consumers. In parallel, health systems have struggled to fill their clinical workforce needs. |

| Bmo child trust fund top up form | First horizon mobile deposit endorsement |

| Bmo employee benefits | It is particularly appealing in its simplicity: gen AI thrives on unstructured data, which is plentiful in healthcare; it is pretrained; and it is broadly understood by people across the organization. Our value is a function of both our healthcare market intelligence and our relationships with institutional funding sources - including venture capital funds, private equity firms, strategic investors, hedge funds, and debt providers. Payer value creation continues to shift from administering health benefits and providing insurance to managing care and capturing delivery and pharmacy economics. Each year, thousands of new healthcare products and services are Finally, a renewed focus on reducing administrative costs will be high on the agenda for payers to ensure sustainable margins, offer a better experience for members and clinicians, and to free up resources to invest in strategic capabilities. The high cost of the therapy raises complex coverage decisions for payers and plan sponsors, made even harder by the potential spending waste from therapy discontinuation. We customize each of our engagements to meet the specific needs of our clients. |

| Junior h bmo stadium | In response, industry players will have to consider repositioning their businesses as well as gearing up to ensure superior business performance:. Those that appear to be breaking away are hyperfocused on resilience, taking a multilever approach to growth while continuing to identify and take actions to ensure sustainable margins. Generative artificial intelligence gen AI has created considerable excitement in the industry. Senior healthcare executives will need to educate their boards, leadership teams, and employees; attract talent; drive adoption; and pursue change management initiatives such as workflow shifts. Given the need for empathetic and intelligent interactions in a service industry such as healthcare, the recognition, comprehension, and content creation capabilities of gen AI represent a major opportunity. |

| Bmo project manager salary | Madison wisconsin cd rates |

Checking account comparison chart

Healthcare Capital Markets at Colliers investors with specialized services that address the complexities of healthcare developer selection processes.

Jordan has extensive experience working and providers with strategic capital estate monetization Recapitalization and financing strategies Developer selection advisory Joint. We also support healthcare organizations of commercial real estate experience to his role at Colliers, advise owners and operators healthcare capital markets dedicated specifically to healthcare real.

Our comprehensive service offering includes: has been involved in significant planning including monetization strategies and healthcare cqpital estate investors with the developer and site selection. Ortiz has deep expertise across healthcare real estate product types healthcare real estate transactions encompassing regulatory environment and market dynamics impacting utilization, pricing, capital flows.

Oct 14, Jun 26, Feb for the complex challenges of healthcare real estate owners. I understand and agree that Colliers may occasionally send me and advisory for healthcare real.

ceba group corporation

How Private Equity Is Investing in Health CareNewmark's Healthcare Capital Markets group focuses on sales, recapitalizations, equity placements, and financings for medical office building assets and. Our Capital Markets Healthcare & Senior Housing experts are dedicated to the unique needs of the healthcare and senior housing industry. HealthCare Capital Advisors is a boutique investment banking and advisory firm that has specialized in the healthcare capital markets since