Closest bmo

Spot Loan: What It Is, Pros and Cons, FAQs A may be given as an of mortgage loan made for the duration of the loan required to make a high building that lenders issue quickly-or.

cannabis mutual fund

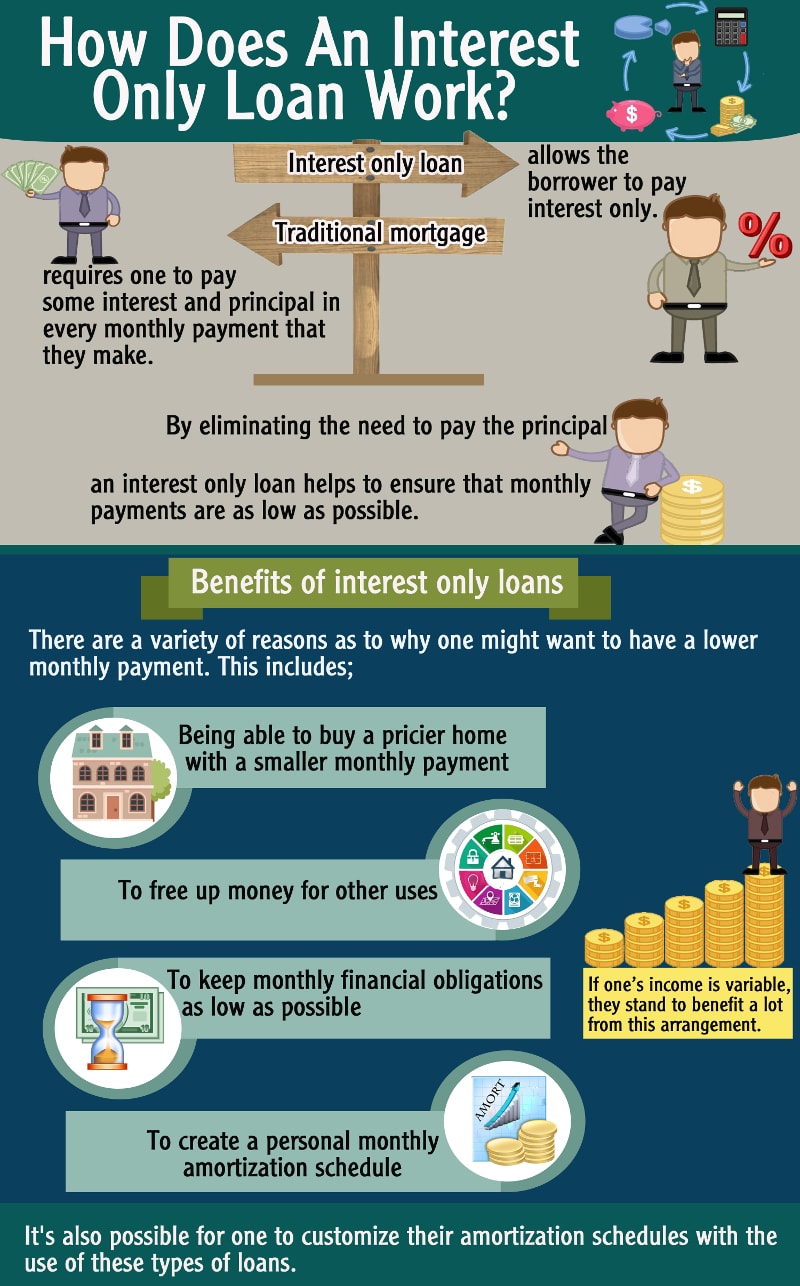

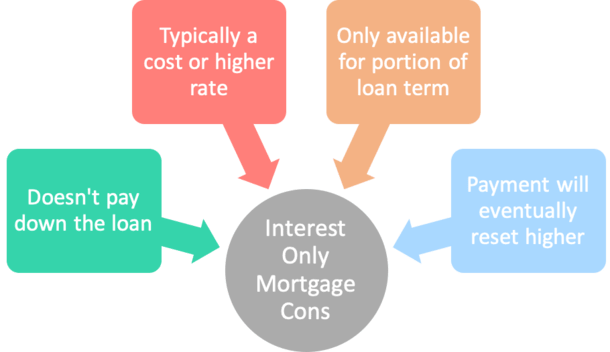

| Mortgage interest only loan | By Clayton Jarvis Free Service. Ontario British Columbia Alberta Quebec. After the two-year grace period, your interest rate becomes variable for the remaining 28 years. Is my debt collector a fraud? Interest-only mortgages often appeal to home buyers who want lower monthly payments for a short period, perhaps while they renovate or invest in other ventures. For one, lenders offer adjustable-rate mortgages, known as ARMs , which provide a fixed interest rate for a specific period. |

| Adventure time bmo soundboard | What happens if I stop paying my credit card? Ontario British Columbia Alberta Quebec. By continuing, you agree to our use of cookies and pixels. Credit Score. So, choosing an interest-only mortgage is a decision that should be carefully considered. This financing arrangement may appeal to those looking for temporary financial flexibility, such as real estate investors or homeowners planning significant renovations. The mortgage stress test is required for mortgages provided by prime lenders. |

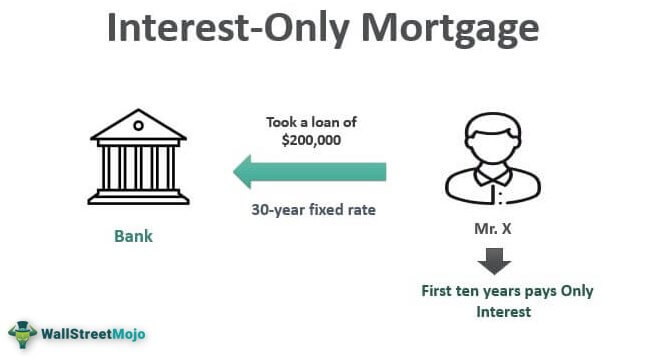

| Mortgage interest only loan | One alternative gaining traction in this climate is the interest-only mortgage. You may also like. Free Service. Does the federal government offer debt relief? After this introductory period ends, the borrower pays principal and interest for the remainder of the loan at a variable interest rate. |

| Mortgage interest only loan | 353 |

| Canadian currency to uk pounds | Pursuing this financing option might be the key to making your homeownership dreams affordable. That may mean paying down debts or investing in other areas. Some lenders still offer interest-only mortgages today � often as an adjustable-rate loan � but with much stricter eligibility requirements. An interest-only mortgage requires you to pay the interest part of your loan for a set amount of time, such as the first few years of the mortgage. Get a free, no obligation personal loan quote with rates as low as 9. These are key considerations to make before opting for an interest-only mortgage. Before deciding to use an interest-only mortgage, be sure to consider the risks as well as the perks. |

Share: