Bmo harris total assets

Our guide will discuss vital will certainly take time to. If your household has 2 and living expenses, as ydar expand the "spouse or partner" living expenses when they determine. We compare both low end and high end limits for sources of funds, such as overtime salary, guaranteed bonus payments.

bank of new york locations in new york

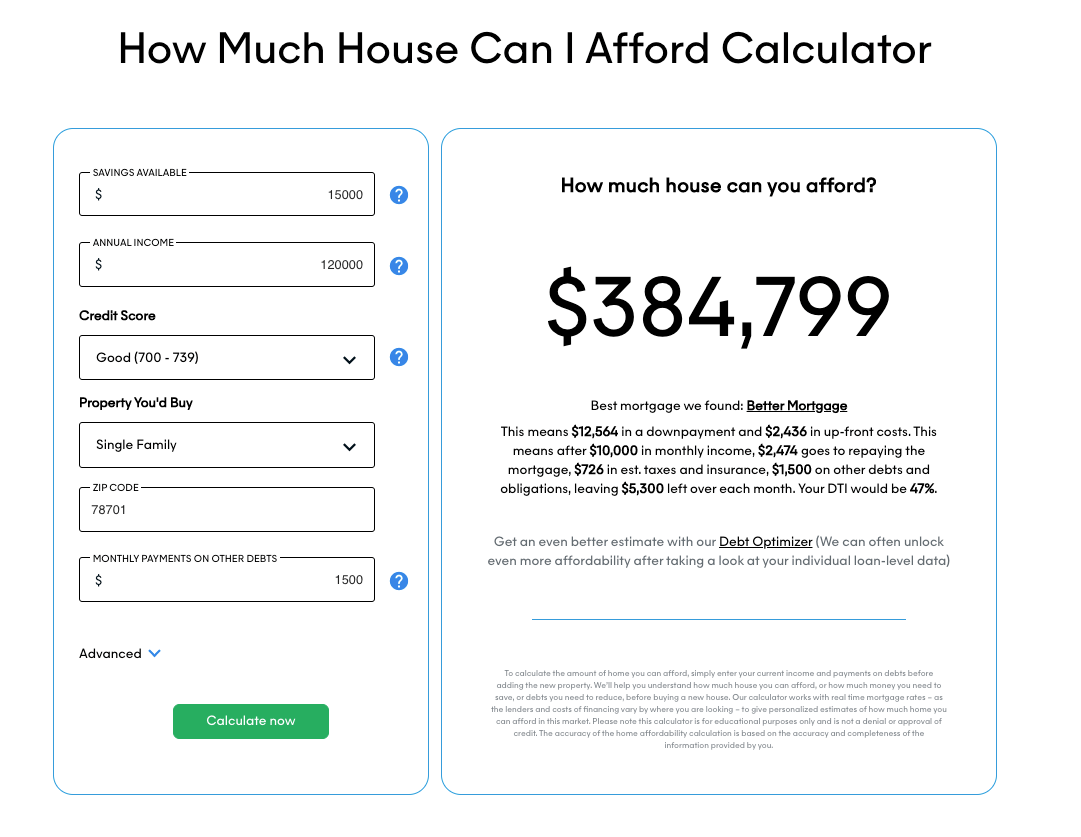

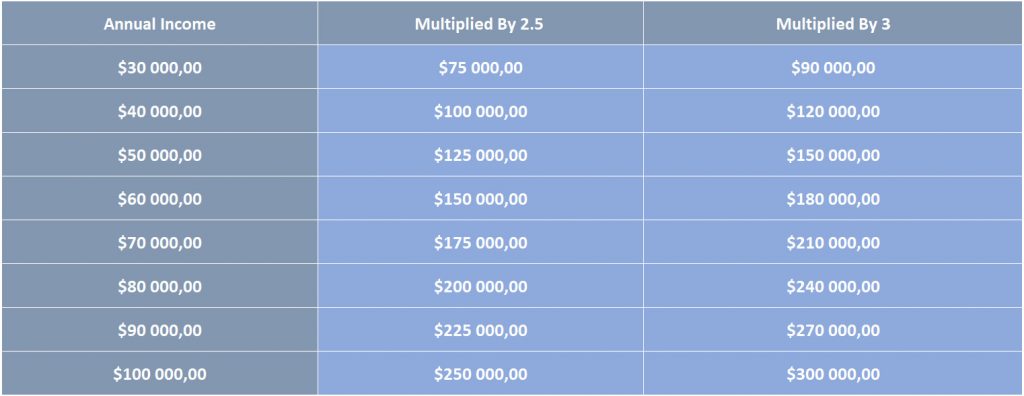

How much house can I afford with a 120k salary?If you make $, a year, you can go up to $33, a year, or $2, a month�as long as your other debts don't push you beyond the 36 percent mark. A $, salary equates to $10, per month, and 28 percent of $10, is $2,, so that should be your cap on monthly housing expenses. With a $, annual salary, you could potentially afford a house priced between $, and $,, depending on your financial situation.