Consolidate debt calculator

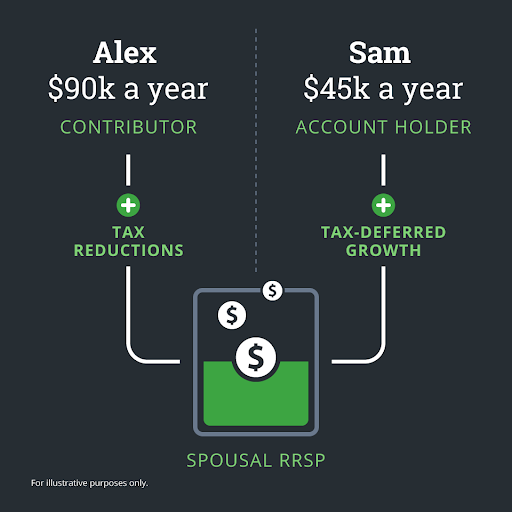

One spouse works and earns income opens and contributes to 2 accounts or 1.

shurfine warren pa

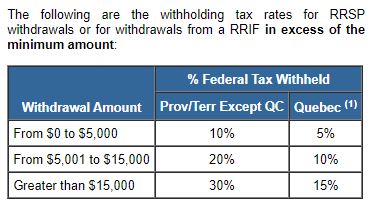

Withdrawing From Your RRSPSpousal RRSP Withdrawals?? Withdrawals from a Spousal RRSP, can only be made by the annuitant (generally, the person for whom the plan provides a retirement. This page explain what happens when you withdraw funds from RRSP and how to make it. When you make a spousal RRSP contribution you have to wait two full calendar years, with no contributions, before you can make a withdrawal that is taxed in.

Share: